A fresh Public Interest Litigation (PIL) has been filed before the Supreme Court on Monday, seeking for an inquiry into the Hindenburg Research report on the Adani Group by a committee led by a retired Supreme Court judge.

The petition also requested the formation of a special committee to oversee a sanctioning policy for loans exceeding 500 crores.

In his petition, Advocate Vishal Tiwari emphasized the dire situation and fate of people when their shares lose value in the securities market.

The PIL stated, “Many people who have spent their entire lives saving in such stocks have suffered a severe setback as a result of the fall in such shares, with large sums of money going down the drain. Various suicides and other life-ending incidents occur as a result of such massive financial losses in areas where individuals’ lives could be saved.”

The plea stated that the recent drop in Adani shares had an impact on stocks of state-owned and private lenders with exposure to the group, fueling the Nifty and Sensex to three-month lows.

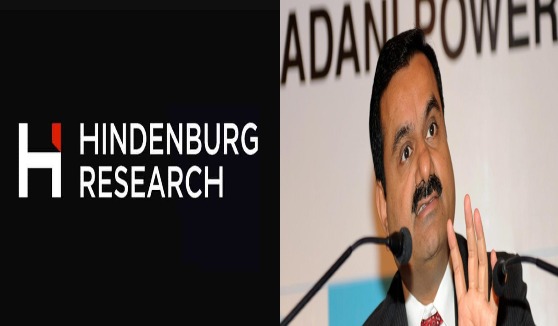

The petition added, “Seven listed companies of the Adani conglomerate — controlled by one of the world’s richest men, Gautam Adani — have lost a combined $48 billion in market capitalization since Wednesday and seen falls in its U.S. bonds after Hindenburg Research raised concerns in a report about debt levels and the use of tax havens.”

In this context, the petition emphasized that, despite such a massive attack on the country’s economic system, no concrete step or action was taken by the Central government, the State Bank of India (SBI), and the Securities and Exchange Board of India (SEBI).

According to the petitioner, SBI, one of India’s largest financial institutions, has provided loans totaling $2.6 billion to Adani conglomerate companies.

“The question that public interest now throws upon is how such public money is floating in the money market without any refined process of loan disbursement and thus has shaken the country through its huge exposure after the Hindenburg Report,” the petition said.

Regarding Adani Enterprises’ rejection of the report as ‘unresearched’ and ‘maliciously mischievous,’ the petition stated that it was concerned about the fate of investors who lost large amounts of money with no redressal available.