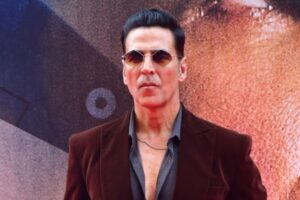

Bollywood actor Akshay Kumar has approached the Bombay High Court seeking protection of his personality and publicity rights amid a surge in unauthorised use of his identity, including AI-generated content and deepfake... Read more »

The Central Bureau of Investigation on Wednesday arrested the Executive Director and Regional Officer of the National Highways & Infrastructure Development Corporation Limited, Guwahati office, for allegedly accepting a bribe of ₹10... Read more »

The Supreme Court on Wednesday laid down detailed interim guidelines permitting the sale and use of green firecrackers in Delhi and the NCR for a limited period around Diwali. The directions aim... Read more »

The Delhi High Court on Wednesday clarified that the professional office of a lawyer does not fall under the category of “commercial activity” under the New Delhi Municipal Council (NDMC) Act. The... Read more »

The Delhi High Court on Tuesday permitted actor Rajpal Yadav to travel to Dubai to attend a Diwali celebration event, despite an ongoing cheque bounce case against him. Justice Swarana Kanta Sharma... Read more »

Sharjeel Imam, an accused in the Delhi riots case, on Tuesday withdrew his plea for interim bail from the Karkardooma Court, allowing him to file his nomination papers for the Bihar Assembly... Read more »

The Delhi High Court on Tuesday granted 10 days’ interim bail to Naresh Sehrawat, a life convict in the 1984 anti-Sikh riots case. Sehrawat was sentenced to life imprisonment in 2018 by... Read more »

The Supreme Court on Tuesday postponed the hearing on a plea filed by Gitanjali J Angmo, wife of climate activist Sonam Wangchuk, challenging his detention under the National Security Act and seeking... Read more »

The Supreme Court on Tuesday refused to entertain a plea by Daman and Diu MP Umeshbhai Babubhai Patel, who sought a court-monitored SIT probe into alleged financial irregularities involving approximately ₹33 crore... Read more »