The worldwide practice of resorting to arbitration in terms of dealing with sports-related disputes did not really transpire instantaneously; It rather emanated from the general consensus among the sports sectors’ stakeholders who... Read more »

The Bombay High Court issued notices to lawyers regarding their conduct, not as citizens but as advocates and pleaders. The court observed that it had “nothing to do with their political views”... Read more »

It’s rightly said that “Law of nations is nothing but a law of nature applied to nations in a state of natural liberty.” An insightful dealing with the genesis of public international... Read more »

Introduction Hindustan Unilever Limited (HUL), a subsidiary of British-Dutch multinational company Unilever PLC and the home-grown Kolkata-based FMCG firm Emami have a history of trademark conflicts and defaming each other in in... Read more »

As per the litigation trend in courts, it appears that the government is adamant to pursue several litigations pertaining to transitional credit. Despite a settled position in law that credit is a... Read more »

GST is a new legislation however, its development has spanned over two decades which steals its novelty. Despite years of planning and designing, the Act is still evolving and improvising. The new... Read more »

The Supreme Court, while hearing a petition in September 2016, mandated the government to audit and keep a check on the use of public funds, by NPOs. These entities, based on their... Read more »

This could be the transformation of JIO from a pure play telecom player to emerge as a full-service digital company Read more »

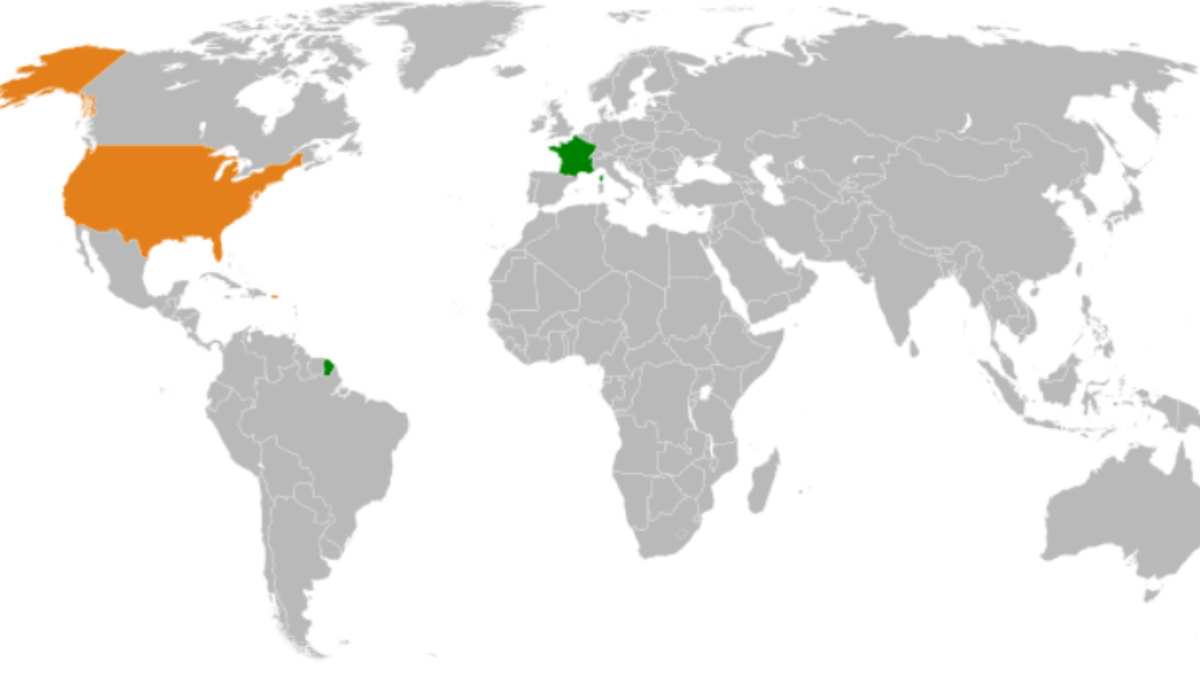

When France imposed its 3% digital services tax on large US digitized businesses, the US trade representative responded by imposing additional duties of up to 100% tariffs on French products worth USD... Read more »

In the wake of the global pandemic COVID-19 crisis, which has not only lead to months of nation-wide lockdown and curfew, it has also ‘almost’ crippled the economy and needless to say,... Read more »